Do you know that “Tata Steel” is setup in 1907 and this was Asia’s first integrated private steel company. This company is mainly into the business of Steel manufacturing. If we talk about products manufacturing by Tata Steel it’s list is vide range including hot rolled coils, cold rolles coils, galvanised steel and long products such as wire rods, rebar, ferro, alloys, tubes, bearing and wires. Tata steel is diversifying it’s products to reach widely. We are going to read a blog for Tata steel share price target 2040, this prices will be based on fundamental of the company and with help of machine learnings on the basis of past trends.

Also Read: Renuka Sugar share price target

Shareholding Pattern of Tata Steel

Promoters holding in the company is 33.19% increased over the period as compare from 2017. FII’s & DII’s holding approx. 43% also giving hope for good future returns in the stock.

Compound Sales and Profit Growth:

As you can see sales in last 3 years have grown but TTM is reduced which is 1st Quarter 2024-25 comparing with previous year. Further, as we already discussed company booked loss in FY 2023-24.

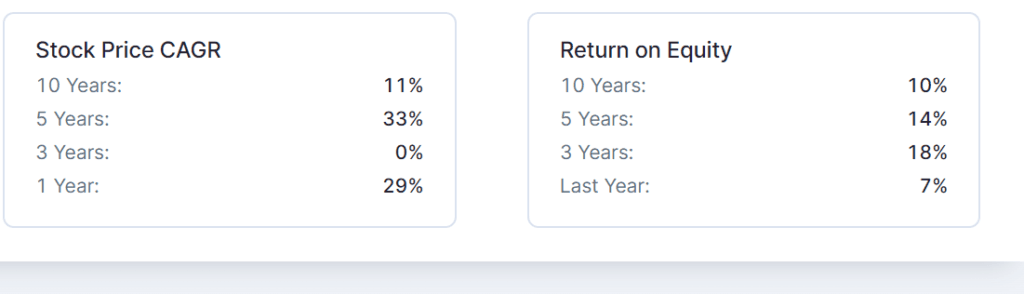

Tata steel Stock Price CAGR and ROE:

CAGR have increased in last 1 year 29%. Further ROE of last 3 years is good but for last year it was down.

Tata Steel Fundamental Analysis:

If we discuss about fundamentals of company we company ROCE and ROE are 7.02% and 6.55% lower as compare to industry. Further, Tata steel current ratio and Return to assets ratio are 0.71 & 2.55% also lower in the industry. Stock PE is high 116 as compare to average industry PE which is 18.8 far more then it’s competitors. Currently Tata steel share is trading at high PE hence we have seen downside of share from top high Rs.185 to CMP Rs.150.

| Narrations | Remarks | Fav/Not Favourable |

|---|---|---|

| Market Cap | Rs.186615 Crore | High Valued |

| Stock PE | 116 | High as compare to Industry |

| Interest Coverage Ratio | 2.01 | Decent to Pay Interest Obligations |

| ROE | 6.55% | Lower as compare to Industry |

| ROCE | 7.02% | Lower as compare to Industry |

| Current Ratio | 0.71 | Lower Side |

| Dividend Yield | 2.41% | Average |

| CMP | Rs.150 | High Valued |

| Return on assets | 2.55% | Low |

| Debt to Equity | 0.95 | Decent Level |

Tata Steel Balance Sheet analysis:

If we discuss about financials of the company then first we are discussing about borrowings which have reduced as compare to 2020. In 2020 borrowings was Rs.116,328 crore and in 2024 it is Rs.87082 crore.

Company fixed assets are increased over the period that indicates company invested in enhancing the plant capacity which is a good sign for a company.

| Narration | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|---|

| Equity Share Capital | 1144.95 | 1197.61 | 1221.21 | 1221.24 | 1247.44 |

| Reserves | 72,431.35 | 73041.16 | 113221.83 | 101,860.86 | 90,788.32 |

| Borrowings | 116,328.20 | 88,501.41 | 75,561.35 | 84,893.05 | 87,082.12 |

| Other Liabilities | 59,244.62 | 81,169.01 | 92,417.28 | 97,420.63 | 90,194.54 |

| Total | 249,149.12 | 243,909.19 | 282,421.67 | 285,395.78 | 269,312.42 |

| Net Block | 134,550.66 | 135,775.18 | 133,287.83 | 146,621.46 | 148,814.38 |

| Capital Work in Progress | 19496.83 | 19007.4 | 22045.55 | 31213.02 | 34355.53 |

| Investments | 6285.18 | 10681.93 | 13139.85 | 8410.31 | 6257.57 |

| Other Assets | 88816.45 | 78444.68 | 113948.44 | 99150.99 | 79884.94 |

| Total | 249149.12 | 243909.19 | 282421.67 | 285395.78 | 269312.42 |

| Working Capital | 29571.83 | -2724.33 | 21531.16 | 1730.36 | -10309.6 |

| Debtors | 7884.91 | 9539.84 | 12246.43 | 8257.24 | 6263.53 |

| Inventory | 31068.72 | 33276.38 | 48824.39 | 54415.33 | 49157.51 |

| Debtor Days | 20.58404453 | 22.27876687 | 18.32252073 | 12.38487481 | 9.975915996 |

| Inventory Turnover | 4.500238504 | 4.696850439 | 4.996666011 | 4.472134783 | 4.661968843 |

Tata Steel Profit and Loss Analysis:

If we talked about Profit and loss account of the company Tata steel it’s sales are growing YOY basis till 2023. However in 2024 sales reduced but not majorly reduced. This is also one of the reason for price dropped of the company. Further, another reason for price falling of the stock is loss booked by the company for FY 2023-24. However loss was in exceptional nature hence we need not to worry much about the loss as Exceptional nature of losses are in nature of non operating loss.

| Narration | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|---|

| Sales | 139816.65 | 156294.18 | 243959.17 | 243352.69 | 229170.78 |

| Expenses | 122,353.59 | 125,789.92 | 180,469.22 | 211,052.53 | 206,922.86 |

| Operating Profit | 17463.06 | 30504.26 | 63489.95 | 32300.16 | 22247.92 |

| Other Income | -2,883.63 | 179.78 | 1299.99 | 1568.86 | -6005.23 |

| Depreciation | 8440.73 | 9233.64 | 9100.87 | 9335.2 | 9882.16 |

| Interest | 7533.46 | 7606.71 | 5462.2 | 6298.7 | 7507.57 |

| Profit before tax | -1,394.76 | 13843.69 | 50226.87 | 18235.12 | -1147.04 |

| Tax | -2568.41 | 5653.9 | 8477.55 | 10159.77 | 3762.57 |

| Net profit | 1,556.54 | 7490.22 | 40153.93 | 8760.4 | -4437.44 |

| EPS | 1.381761045 | 6.259637804 | 32.87802342 | 7.168023565 | -3.55464413 |

| Price to earning | 19.51133308 | 12.97039901 | 3.975908112 | 14.57863511 | -43.84405141 |

| Price | 26.96 | 81.19 | 130.72 | 104.5 | 155.85 |

| RATIOS: | |||||

| Dividend Payout | 0.735573773 | 0.399723907 | 0.155107358 | 0.50185608 | 0 |

| OPM | 0.124899717 | 0.195172079 | 0.260248262 | 0.132729825 | 0.09708009 |

Tata Steel Technical analysis:

As you can see technical chat of the company in the month of July 2024 Stock prices was fallen upto Rs.85 where this share found a strong support. Currently stock trading at Rs.150 where also found a support. In the long run if company profit going up share price will definitely grow even fundamentally company looking wear in terms of ROE & ROCE.

Tata Steel Share Price Target 2040, 2030, 2025

Since share price prediction for 2025, 2030 and 2040 is very difficult since it will depend upon many factors but as per past records and fundamental with the help of machine learning we can find out as below:

| Year | Expected Price |

| Tata Steel share price target 2025 | Rs.190 |

| Tata Steel share price target 2026 | Rs.215 |

| Tata Steel share price target 2027 | Rs.238 |

| Tata Steel share price target 2028 | Rs.256 |

| Tata Steel share price target 2029 | Rs.288 |

| Tata Steel share price target 2030 | Rs.266 |

| Tata Steel share price target 2031 | Rs.298 |

| Tata Steel share price target 2032 | Rs.325 |

| Tata Steel share price target 2033 | Rs.367 |

| Tata Steel share price target 2034 | Rs.388 |

| Tata Steel share price target 2035 | Rs.376 |

| Tata Steel share price target 2036 | Rs.399.5 |

| Tata Steel share price target 2037 | Rs.423 |

| Tata Steel share price target 2038 | Rs.456 |

| Tata Steel share price target 2039 | Rs.488 |

| Tata Steel share price target 2040 | Rs.501 |

Tata Steel Share Price Target 2024-2025

| Months | Expected Price |

| Tata Steel share Price Target Oct 2024 | Rs.155 |

| Tata Steel share Price Target Nov 2024 | Rs.166 |

| Tata Steel share Price Target Dec 2024 | Rs.167 |

| Tata Steel share Price Target Jan 2025 | Rs.161 |

| Tata Steel share Price Target Feb 2025 | Rs.165 |

| Tata Steel share Price Target March 2025 | Rs.171 |

| Tata Steel share Price Target April 2025 | Rs.182 |

| Tata Steel share Price Target May 2025 | Rs.178 |

| Tata Steel share Price Target June 2025 | Rs.190 |

| Tata Steel share Price Target July 2025 | Rs.201 |

| Tata Steel share Price Target Aug 2025 | Rs.210 |

| Tata Steel share Price Target Sept 2025 | Rs.198 |

| Tata Steel share Price Target Oct 2025 | Rs.196 |

| Tata Steel share Price Target Nov 2025 | Rs.205 |

| Tata Steel share Price Target Dec 2025 | Rs.190 |

Tata Steel Share Price Target 2030

| Months | Expected Price |

| Tata Steel share Price Target Jan 2030 | 288 |

| Tata Steel share Price Target Feb 2030 | 291 |

| Tata Steel share Price Target March 2030 | 302 |

| Tata Steel share Price Target April 2030 | 325 |

| Tata Steel share Price Target May 2030 | 312 |

| Tata Steel share Price Target June 2030 | 298 |

| Tata Steel share Price Target July 2030 | 287 |

| Tata Steel share Price Target Aug 2030 | 291 |

| Tata Steel share Price Target Sept 2030 | 281 |

| Tata Steel share Price Target Oct 2030 | 277 |

| Tata Steel share Price Target Nov 2030 | 269 |

| Tata Steel share Price Target Dec 2030 | 266 |

Tata Steel Share Price Target 2035

| Months | Expected Price |

| Tata Steel share Price Target Jan 2030 | 388 |

| Tata Steel share Price Target Feb 2030 | 391 |

| Tata Steel share Price Target March 2030 | 402 |

| Tata Steel share Price Target April 2030 | 425 |

| Tata Steel share Price Target May 2030 | 412 |

| Tata Steel share Price Target June 2030 | 398 |

| Tata Steel share Price Target July 2030 | 383 |

| Tata Steel share Price Target Aug 2030 | 397 |

| Tata Steel share Price Target Sept 2030 | 386 |

| Tata Steel share Price Target Oct 2030 | 367 |

| Tata Steel share Price Target Nov 2030 | 379 |

| Tata Steel share Price Target Dec 2030 | 366 |

Tata Steel Share Price Target 2040

| Months | Expected Price |

| Tata Steel share Price Target Jan 2030 | 488 |

| Tata Steel share Price Target Feb 2030 | 499 |

| Tata Steel share Price Target March 2030 | 510 |

| Tata Steel share Price Target April 2030 | 523 |

| Tata Steel share Price Target May 2030 | 502 |

| Tata Steel share Price Target June 2030 | 505 |

| Tata Steel share Price Target July 2030 | 497 |

| Tata Steel share Price Target Aug 2030 | 515 |

| Tata Steel share Price Target Sept 2030 | 525 |

| Tata Steel share Price Target Oct 2030 | 508 |

| Tata Steel share Price Target Nov 2030 | 510 |

| Tata Steel share Price Target Dec 2030 | 505 |

Also Read: IRFC share price target

Disclaimer:We are not registered with SEBI and not giving any tips or recommendation. This is only for knowledge purpose. Please advise with you financial advisor before taking any IPO or stocks.

Tata steel share price target 2025

It is estimated on the basis of fundamental and technical view price would be around Rs.190

Tata steel share price target 2026

It is estimated on the basis of fundamental and technical view price would be around Rs.215

Tata steel share price target 2027

It is estimated on the basis of fundamental and technical view price would be around Rs.238

Tata steel share price target 2030

It is estimated on the basis of fundamental and technical view price would be around Rs.266

Tata steel share price target 2033

It is estimated on the basis of fundamental and technical view price would be around Rs.367

Tata steel share price target 2035

It is estimated on the basis of fundamental and technical view price would be around Rs.376

Tata steel share price target 2037

It is estimated on the basis of fundamental and technical view price would be around Rs.423

Tata steel share price target 2040

It is estimated on the basis of fundamental and technical view price would be around Rs.501

Tata Steel Debt to Equity Ratio

Tata steel debt to equity ratio is 0.95