ITC limited is basically known majorly for two reason, one is Hotel and other one is Cigarette. If you are also thinking same then you are wrong. You will be shocked to know about ITC business and products. Further, we will understand ITC share price target 2030 with fundamentally and technically.

Table of Contents

ITC Ltd an Overview at glance:

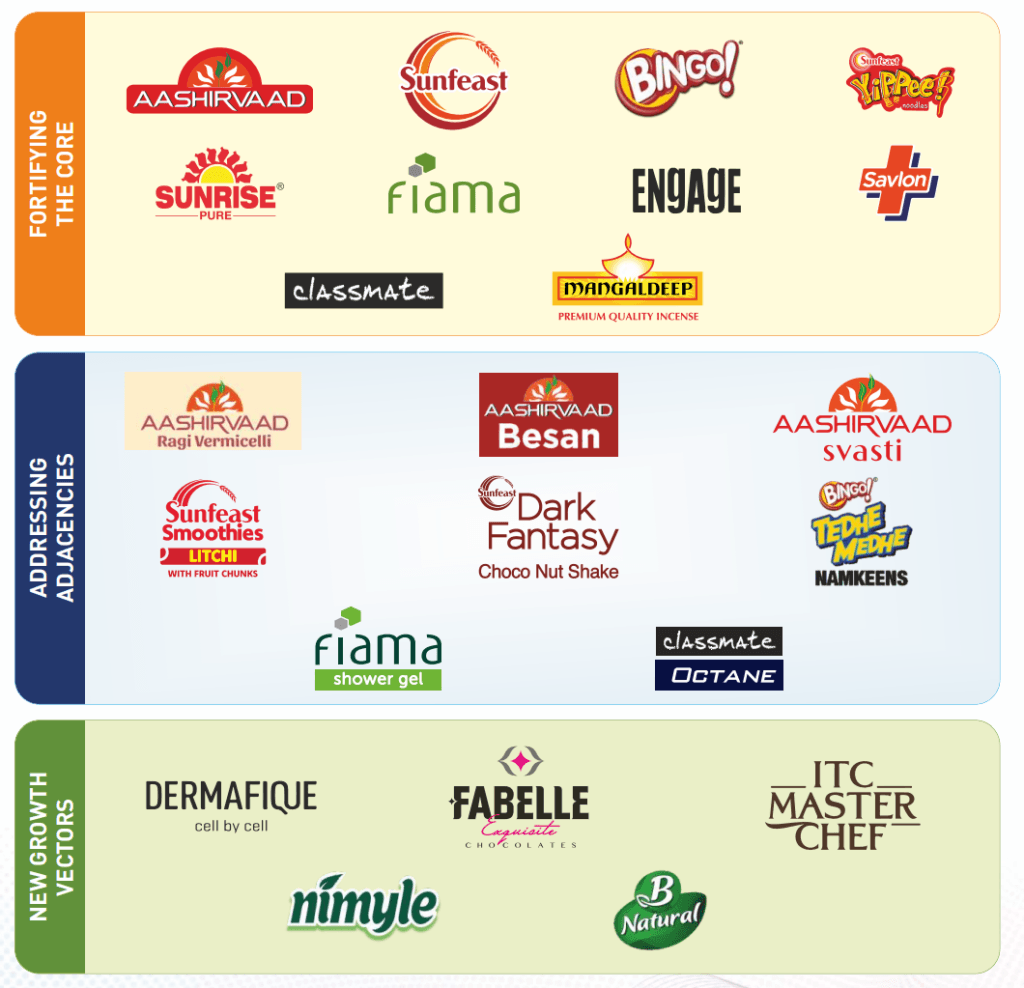

ITC was establish in 1910, this company is largest manufacturer and seller of cigarette. Mainly ITC having 5 segment at present – FMCG cigarettes, FMCG Others, Hotels, Paperboards, Paper & Packaging and agri businesses. You will be shocked by knowing that Cigarettes business is contributing 40% in revenue of total ITC revenue but 80% contributing PBIT of company.

Fundamental Analysis of ITC Limited

To figure out ITC share price target 2030 we have to deep dive into fundamental aspects of the company. Currently ITC limited market cap is Rs.615,500 Crore as on 15th Aug 2024 at stock PE of 30.BROCE is 37.5% and ROE is 28.4 of the company.

Pros of ITC Limited

- ITC company is almost debt free.

- Company is generating good ROE and ROCE for it’s shareholders.

- Company also giving high dividend to it’s shareholders

Cons of ITC Limited

- Stock trading at high as compare to it’s book value.

- Company is still struggling to maintain good sales growth.

Peers Group and it’s PE Ratio

| Name of Company | Current Market Price | PE Ratio |

| Godfrey Phillips | Rs.4343 | 25 |

| VST Industries | Rs.4118 | 23 |

Profit and Loss Account of ITC Limited

| Narration | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|---|

| Sales | 49387.7 | 49257.45 | 60644.54 | 70919.03 | 70866.22 |

| Expenses | 30,044.16 | 32,192.67 | 40,021.39 | 45,214.77 | 44,633.66 |

| Operating Profit | 19,343.54 | 17,064.78 | 20,623.15 | 25,704.26 | 26,232.56 |

| Other Income | 2,417.32 | 2,576.95 | 1,909.72 | 2,097.64 | 2,803.77 |

| Depreciation | 1,644.91 | 1,645.59 | 1,732.41 | 1,809.01 | 1,816.39 |

| Interest | 81.38 | 57.97 | 59.99 | 77.77 | 80.06 |

| Profit before tax | 20,034.57 | 17,938.17 | 20,740.47 | 25,915.12 | 27,139.88 |

| Tax | 4,441.79 | 4,555.29 | 5,237.34 | 6,438.40 | 6,388.52 |

| Net profit | 15,306.23 | 13,161.19 | 15,242.66 | 19,191.66 | 20,458.78 |

| EPS | 12.45 | 10.69 | 12.37 | 15.44 | 16.39 |

| Price to earning | 13.79 | 20.43487557 | 20.26 | 24.83 | 26.14 |

| Price | 171.7 | 218.5 | 250.65 | 383.5 | 428.35 |

| RATIOS: | |||||

| Dividend Payout | 0.82 | 1.01 | 0.93 | 1.00 | 0.84 |

| OPM | 0.391667156 | 0.346440589 | 0.340066064 | 0.362445172 | 0.37017016 |

Balance Sheet of ITC Limited

| Narration | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|---|

| Equity Share Capital | 1229.22 | 1230.88 | 1232.33 | 1242.8 | 1248.47 |

| Reserves | 64,044.04 | 59,116.46 | 61,223.24 | 67,912.46 | 73,258.53 |

| Borrowings | 277.45 | 270.83 | 249.44 | 306.04 | 303.43 |

| Other Liabilities | 11,760.04 | 13,142.59 | 14,491.01 | 16,369.66 | 16,943.54 |

| Total | 77,310.75 | 73,760.76 | 77,196.02 | 85,830.96 | 91,753.97 |

| Net Block | 21,713.34 | 23,298.48 | 24,231.59 | 25,851.27 | 27,820.22 |

| Capital Work in Progress | 3,256.46 | 4,011.29 | 3,225.54 | 3,003.30 | 2,860.78 |

| Investments | 28,663.35 | 24,870.87 | 24,841.01 | 29,415.02 | 31,114.02 |

| Other Assets | 23677.6 | 21580.12 | 24897.88 | 27561.37 | 29958.95 |

| Total | 77310.75 | 73760.76 | 77196.02 | 85830.96 | 91753.97 |

| Working Capital | 11917.56 | 8437.53 | 10406.87 | 11191.71 | 13015.41 |

| Debtors | 2562.48 | 2501.7 | 2461.9 | 2956.17 | 4025.82 |

| Inventory | 8879.33 | 10397.16 | 10864.15 | 11771.16 | 14152.88 |

| Debtor Days | 18.94 | 18.54 | 14.82 | 15.21 | 20.74 |

| Inventory Turnover | 5.56 | 4.74 | 5.58 | 6.02 | 5.01 |

| Return on Equity | 0.23 | 0.22 | 0.24 | 0.28 | 0.27 |

| Return on Capital Emp | 0.29 | 0.34 | 0.39 | 0.38 |

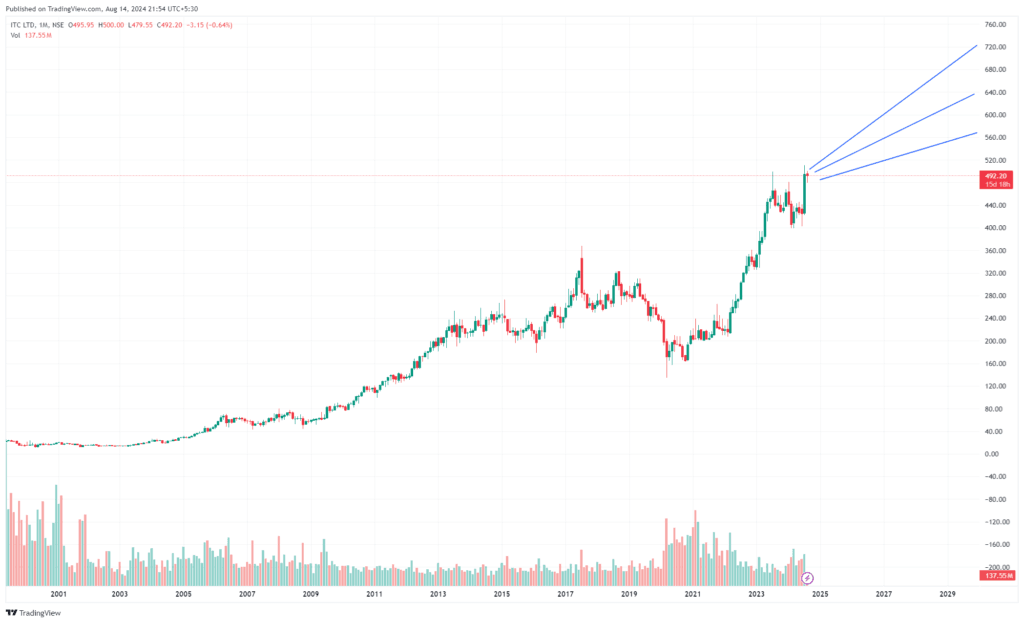

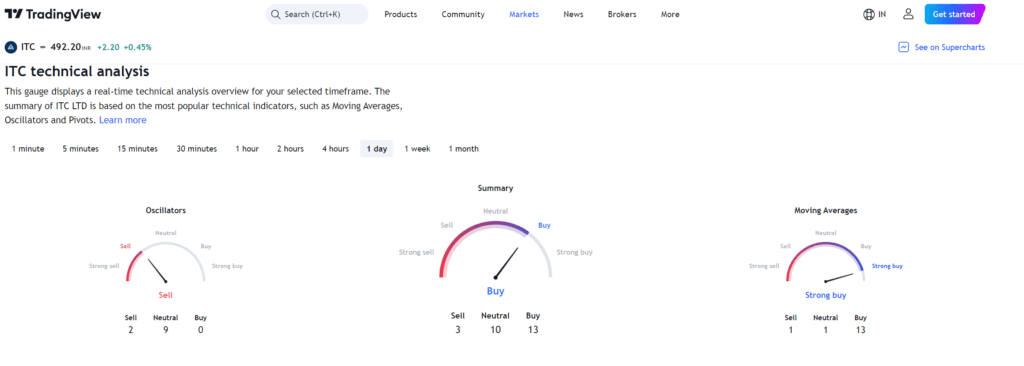

Technical Understanding of ITC Limited

If you will analysis technically and also checkout multiple houses who are experts are giving positive feedback of the ITC stock for future prices.

If we will check trading view it is giving given below:

ITC Share Price Target 2030

ITC share price for next 12 Months

| Months | Favourable | Not Favourable |

|---|---|---|

| Sep-24 | 510 | 480 |

| Oct-24 | 515.00 | 500.00 |

| Nov-24 | 525.00 | 505.00 |

| Dec-24 | 530.00 | 510.00 |

| Jan-25 | 550.00 | 520.00 |

| Feb-25 | 575.00 | 525.00 |

| Mar-25 | 570.00 | 535.50 |

| Apr-25 | 580.00 | 546.21 |

| May-25 | 585.00 | 557.13 |

| Jun-25 | 600.00 | 568.28 |

| Jul-25 | 625.00 | 579.64 |

ITC Share Price Target for 2025, 2026, 2027, 2028, 2029, 2030

| Months | Expected Share Price |

|---|---|

| Aug-25 | 625 |

| Aug-26 | 700 |

| Aug-27 | 823 |

| Aug-28 | 901 |

| Aug-29 | 999 |

Also Read: NHPC share price target 2040

Disclaimer:We are not registered with SEBI and not giving any tips or recommendation. This is only for knowledge purpose. Please advise with you financial advisor before taking any IPO or stocks.

FAQ’s of ITC Share

ITC Share Price Target 2025

It is expected share price target is Rs.625

ITC Share Price Target 2026

It is expected share price target is Rs.700

ITC Share Price Target 2027

It is expected share price target is Rs.823

ITC Share Price Target 2028

It is expected share price target is Rs.901

ITC Share Price Target 2029

It is expected share price target is Rs.999