Shree Renuka Sugars incorporated in 1995 and is a subsidiary of Wilmar Sugar Holding Pte Limited. Renuka Sugar operating 6 Plants situated in Maharashtra, Karnataka and other. Mainly producing sugar from sugarcane and by-product are ethanol, power and organic manures. In this blog we are going to explore fundamentally Renuka sugar share price target 2025 for knowledge purpose.

If we talk about Crushing Capacity are 46000 TCD and distillery capacity of 1250 KLPD. Company also exporting to various companies like Sudan, UAE, Saudi, Nepal, Sri Lanka, Qatar, Indonesia.

Sales bifurcation as per FY 2022 financials are below:

Sugar – 75%

Ethanol – 15%

Traded Sugar and Coal – 7%

Power & By-Product – 3%

Further if we again bifurcate sales for location wise then sales from export is 69% and domestic sales is 31%.

Table of Contents

Corporate Information

| Board of Directors | Name |

| Executive Chairman | Mr. Atul Chaturvedi |

| Executive Director | Mr. Virender Singh |

| Executive Director | Mr. Ravi Gupta |

| Banker | Bank of America, DBS, RBL |

Corporate Office and Plant Location

| Office Type | Address |

| Registered Office | 2nd & 3rd Floor, Kanakashree Arcade, 2nd Floor, CTS No. 10634, JNMC Road, Neharu Nagar, Belagavi -590010, Karnataka |

| Corporate Office | 7th Floor, Devchand House, Shiv Sagar Estate, Dr. Annie Besant Road, Worli, Mumbai – 400 018. Tel: 91-22-2497 7744 / 4001 1400 |

| Plant Office | Total 9 Units in Karnataka, Maharashtra, Gujarat, West Bengal |

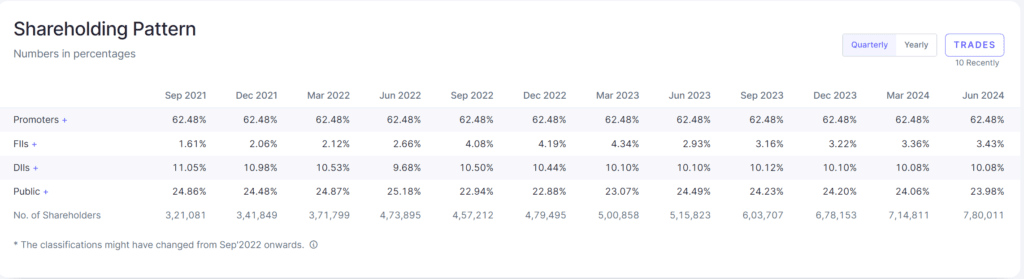

Shareholding Pattern of Renuka Sugar Share

Promoters shareholding improved over the period of time. Promoters are holding approx. 62.48% of shareholding in the company.

Product of Renuka Sugar Dealing with:

Refining of Sugar

Company mainly in the business of processing of Sugarcane and producing white sugar and selling in the name of brand Madhur Sugars.

Also Read: IRFC share price target

Ethanol

Ethyl or Ethanol is basically by-product of sugar manufacturing company which is basically using by alcohol companies for making alcohol and chemical industry for making bio fuels.

Sale of Power

Company also producing power by waste of sugarcanes. Bagasse(Waste of Sugarcane) is by product.

Also Read: ITC share price Target

Renuka Sugar Fundamental Analysis:

Company booked loss of Rs.627 crore in FY 2023-24 end. Further, if we talk about June 2024 end company booked loss of Rs.166 Crore. As company fundamental suggest company is not fundamentally strong company as current ratio are less then 1, ROCE is only 10%, Interest coverage ratio is only 0.68 times. Further, company is in loss hence stock PE can not be calculated as formula of PE suggest Market price divide by earning but company is reported loss in FY 2024, hence Stock PE can not be calculated.

Renuka Sugar Peer company is EID parry and Balarampur Chinni who is in profit.

[table “8” not found /]Renuka Sugar Financials for last 5 years:

Renuka Sugar financials suggest continuously increasing debt of the company which is not a good sign, further stock turnover ratio is not up to mark.

[table “9” not found /]Renuka Sugar Profit & Loss for last 5 years

Renuka Sugar sales are increasing which is a good sign but still is in loss. It is expected to increase profit in coming quatres.

[table “10” not found /]Renuka Sugar Technical overview:

Renuka Sugar Prices was traded high as Rs.114 , approx. 14-15 years back but later reduced due to multiple factors we discussed above. Currently stock price is consolidating and can move above side in 2025 if company book profit and sales increase.

Understand Renuka Sugar Share Price Target 2025

As we understood fundamentally to the company which is not so good due to it’s loss and high debt. Let’s understand fundamentally and technically Renuka Sugar Share price target 2025.

Renuka Sugar Share Price Target 2024-25

| Month | Share Price Target |

| Renuka Sugar Share Price Target Sept 2024 | Rs.46 |

| Renuka Sugar Share Price Target Oct 2024 | Rs.48 |

| Renuka Sugar Share Price Target Nov 2024 | Rs.51 |

| Renuka Sugar Share Price Target Dec 2024 | Rs.56 |

| Renuka Sugar Share Price Target Jan 2025 | Rs.58 |

| Renuka Sugar Share Price Target Feb 2025 | Rs.51 |

| Renuka Sugar Share Price Target March 2025 | Rs.48 |

Renuka Sugar Share Price Target 2025-26

| Month | Share Price Target |

| Renuka Sugar Share Price Target April 2025 | Rs.54 |

| Renuka Sugar Share Price Target May 2025 | Rs.61 |

| Renuka Sugar Share Price Target June 2025 | Rs.67 |

| Renuka Sugar Share Price Target July 2025 | Rs.68 |

| Renuka Sugar Share Price Target Aug 2025 | Rs.72 |

| Renuka Sugar Share Price Target Sept 2025 | Rs.65 |

| Renuka Sugar Share Price Target Oct 2025 | Rs.77 |

| Renuka Sugar Share Price Target Nov 2025 | Rs.74.5 |

| Renuka Sugar Share Price Target Dec 2025 | Rs.72 |

| Renuka Sugar Share Price Target Jan 2026 | Rs.67 |

| Renuka Sugar Share Price Target Feb 2026 | Rs.63.5 |

| Renuka Sugar Share Price Target March 2026 | Rs.68 |

Also Read : NHPC share Price Target

Disclaimer:We are not registered with SEBI and not giving any tips or recommendation. This is only for knowledge purpose. Please advise with you financial advisor before taking any IPO or stocks.

FAQ’s of Renuka Sugar Share Price Target

Renuka Share Price Target Mar 2025

It is expected share price of Renuka Sugar as on march 2025 is Rs.48

Renuka Share Price Target Mar 2026

It is expected share price of Renuka Sugar as on march 2025 is Rs.68

Renuka Share Price Target Mar 2027

It is expected share price of Renuka Sugar as on march 2025 is Rs.89

Renuka Share Price Target Mar 2028

It is expected share price of Renuka Sugar as on march 2025 is Rs.98.5

Renuka Share Price Target Mar 2029

It is expected share price of Renuka Sugar as on march 2025 is Rs.94.3

Renuka Share Price Target Mar 2030

It is expected share price of Renuka Sugar as on march 2025 is Rs.106